After writing about the S&P 500, I thought I had it figured out.

SPY tracks the S&P 500.

The S&P 500 tracks the market.

So just buy SPY and you’re done, right?

But then I did some more research.

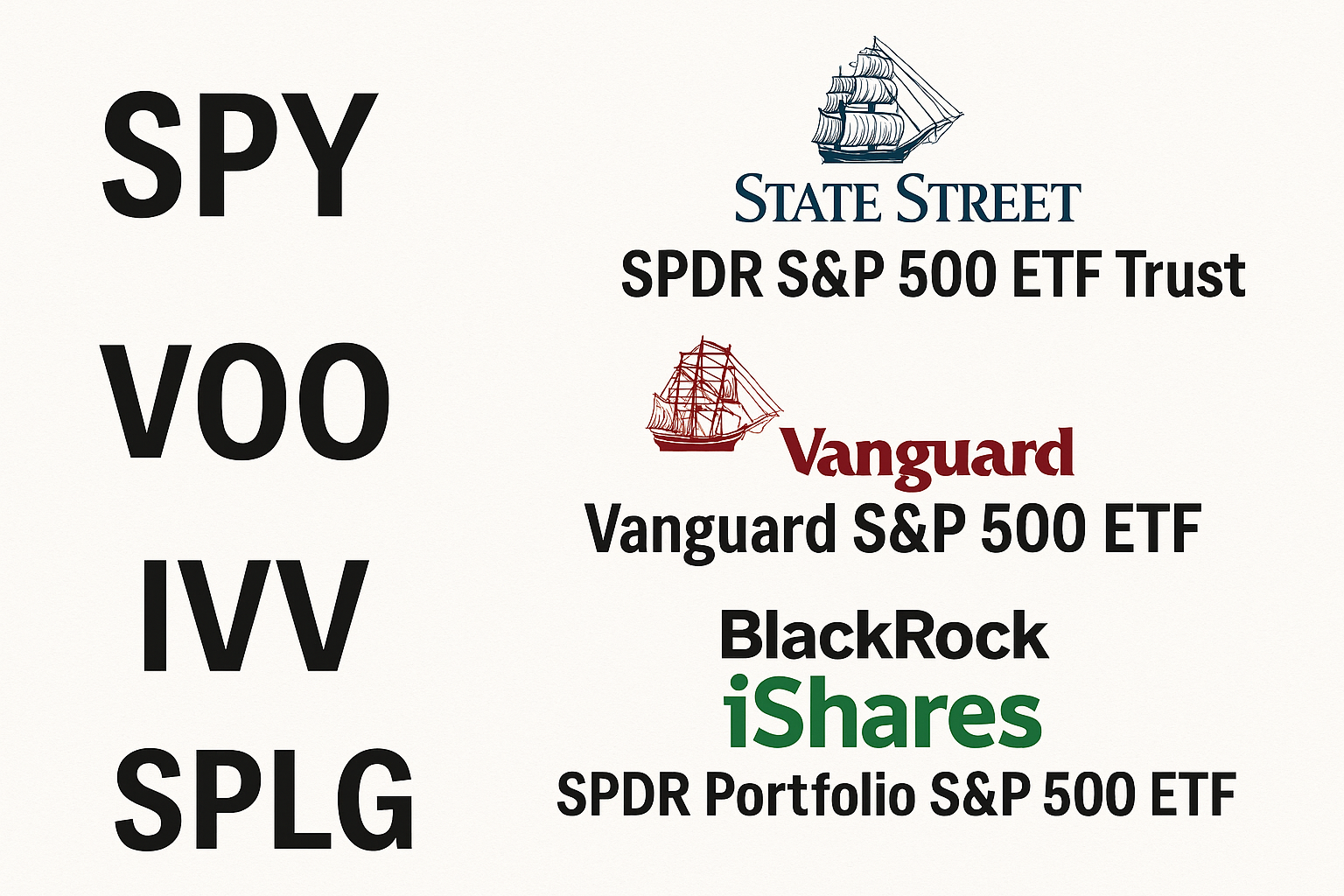

And I found out there are actually lots of ETFs that track the S&P 500.

Not just SPY — there’s VOO, IVV, SPLG, and more.

They all follow the same index, but they do it in different ways.

Here’s what I learned.

1. Different ETFs, same index

All of these ETFs track the same 500 companies — the S&P 500.

But they’re managed by different companies:

| ETF | Company | Full Name |

|---|---|---|

| SPY | State Street | SPDR S&P 500 ETF Trust |

| VOO | Vanguard | Vanguard S&P 500 ETF |

| IVV | BlackRock (iShares) | iShares Core S&P 500 ETF |

| SPLG | State Street | SPDR Portfolio S&P 500 ETF |

Even though the index is the same, the ETFs have small differences in fees, dividends, structure, and even how you buy them.

2. Fees matter

Each ETF charges something called an expense ratio — a small annual fee to manage the fund.

Here’s a comparison:

- VOO: 0.03%

- IVV: 0.03%

- SPLG: 0.02%

- SPY: 0.0945%

That means if you invest $1,000 in SPY, you pay about 95 cents per year in fees.

With VOO, it’s only 30 cents.

The difference seems small, but over time, it adds up — especially if you invest for years.

3. Dividend handling is different too

All S&P 500 companies don’t just grow — some pay out dividends to shareholders.

ETFs that hold those companies also receive those dividends.

But here’s the key: How the ETF handles dividends depends on the fund.

- SPY holds dividends in cash and pays them out every quarter.

- VOO and IVV reinvest them internally before paying you.

- Some brokers offer automatic dividend reinvestment (DRIP) — they use your dividend to buy more ETF shares.

If you want income now, that matters. If you’re investing long term, you might want everything reinvested automatically.

4. Structure and taxes

This is a little more advanced, but I found out that:

- SPY is a unit investment trust (UIT), which limits how it can reinvest dividends.

- VOO and IVV are open-ended funds, which are more flexible.

This affects how efficiently they handle capital gains taxes in the U.S.

Most people don’t notice, but long-term investors sometimes care about tax efficiency.

5. Where I read all this

Here are some links I found helpful during my research:

- Morningstar comparison of SPY vs VOO vs IVV

- NerdWallet: Best S&P 500 ETFs

- ETF.com SPY profile

- ETF.com VOO profile

- ETF.com IVV profile

What does this mean for me?

For now, in my virtual portfolio, I’m keeping SPY.

It’s the most famous and easiest to understand.

But when I eventually invest real money, I might choose something with lower fees — like VOO or SPLG.

Now I know that just saying “S&P 500 ETF” isn’t enough.

You should know which one and why it fits your plan.

What I Learned

- There are many S&P 500 ETFs, not just SPY.

- Different companies run them, and they have different fees.

- Dividend and tax handling can be important over time.

- Always check more than just the name. Read the fine print.

Next time:

Investing sounds fun when the market goes up, but what happens when prices fall?

I want to understand why stock prices move — and how fear and greed play a role.

That’s what I’ll dig into next.

Leave a Reply